FinSight AI: Predictive Finance Intelligence

Accurately forecast stock prices, identify market volatility, and simulate economic risks using FinSight AI. Our deep learning model powered by LSTM and hybrid architectures delivers institutional-grade insights for traders, investors, and analysts.

Key Features

FinSight AI

FinSight AI transforms financial forecasting using cutting-edge deep learning models. From real-time trend analysis to economic indicator simulation and fraud anomaly detection, the platform offers a comprehensive solution for risk-aware decision-making.

-

Customizable Model Setup

Select LSTM, GRU, or Hybrid models, configure lookback periods, forward days, and run parameter-tuned simulations for different assets.

-

AI-Powered Price Predictions

Analyze next price points, volatility scores, and trend direction based on time-series learning from real-world financial datasets.

-

Volatility & Anomaly Detection

Leverage AI clustering and DBSCAN to detect abnormal stock movements and turbulent periods for proactive risk mitigation.

-

Credit Risk Automation

Expedite low-risk credit approvals and streamline high-risk investigations with AI-based risk scoring and prepayment forecasting.

-

Real-Time Fraud Detection

Reduce false positives and detect suspicious activity with real-time AI surveillance, anomaly detection, and AML compliance models.

-

Personalized Customer Engagement

Use predictive AI to tailor marketing offers, recommend products, and score leads improving satisfaction and retention.

-

Predictive Sales & Retention

Leverage AI to forecast client churn, drive cross-sell campaigns, and predict market shifts across portfolios.

-

AML & Trade Surveillance

Support SR 11-7, BSA, and KYC frameworks with AI-powered communication analysis and trade monitoring tools.

-

Dynamic Price Optimization

Forecast price elasticity, generate personalized offers, and optimize quote pricing with RFQ intelligence and market trends.

-

Scenario & Stress Analysis

Simulate economic shocks and stress scenarios across assets with macroeconomic and behavioral forecasting models.

-

Model Risk Management

Deploy and monitor well-governed models that integrate into your MRM lifecycle accelerating approval and regulatory compliance.

-

Market Trend Forecasting

Predict short- and mid-term market movements using time-series signals, technical indicators, and volatility clustering built for investment decision support.

More in FinSight

Why Choose FinSight AI

FinSight is more than a dashboard it's an enterprise-ready framework designed for integration, automation, and institutional reliability.

-

RESTful API & SDK

Use our Python or JS SDK or call the REST API directly to integrate predictions into your trading systems or dashboards.

-

Economic Indicators Engine

Simulate effects of interest rate hikes, inflation changes, and macroeconomic shocks on selected portfolios.

-

Batch Portfolio Analysis

Run model inference across hundreds of assets and time windows ideal for hedge funds and investment firms.

-

Cloud & On-Premise Ready

Deploy FinSight securely on your infrastructure or use our cloud-hosted solution with Docker support.

-

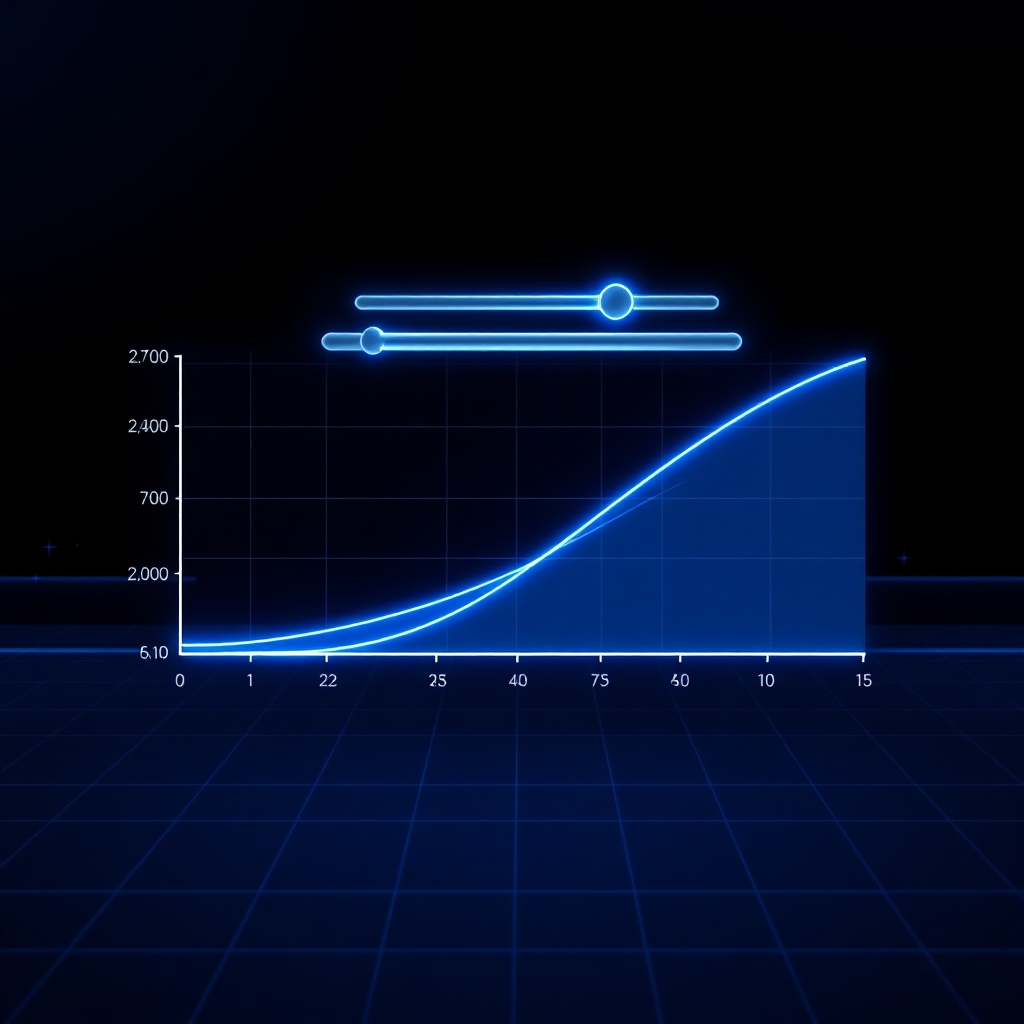

Real-Time Charts

Get instant access to predicted prices, candlestick overlays, and trend graphs for every asset in your portfolio.

-

24/7 Support

Our experts are available round the clock to assist with deployment, model tuning, and custom integration needs.

Ready to Invest Smarter?

Schedule a demo or get API access to explore FinSight’s predictive capabilities. Whether you're a trader, advisor, or fund manager our platform is your edge in financial intelligence.